Annual Gift Exemption 2025 - Gift Annual Exclusion 2025 Lynn Sephira, This generally means that an estate of a decedent who dies in 2025 with. Gift Annual Exclusion 2025 Lynn Sephira, Couple has four children, they can gift up to $152,000.00 tax free.

Gift Annual Exclusion 2025 Lynn Sephira, This generally means that an estate of a decedent who dies in 2025 with.

Homeland Concert Israel 2025. An emotional peak of the 'homeland concert' was when the families of the hostages entered the amphitheater at minute 2:23 in the video. 4,284,777 views dec 29, 2023 we wanted to share this inspirational music video produced in the caesarea amphitheatre by over 1000 israelis, some who are fam. homeland concert […]

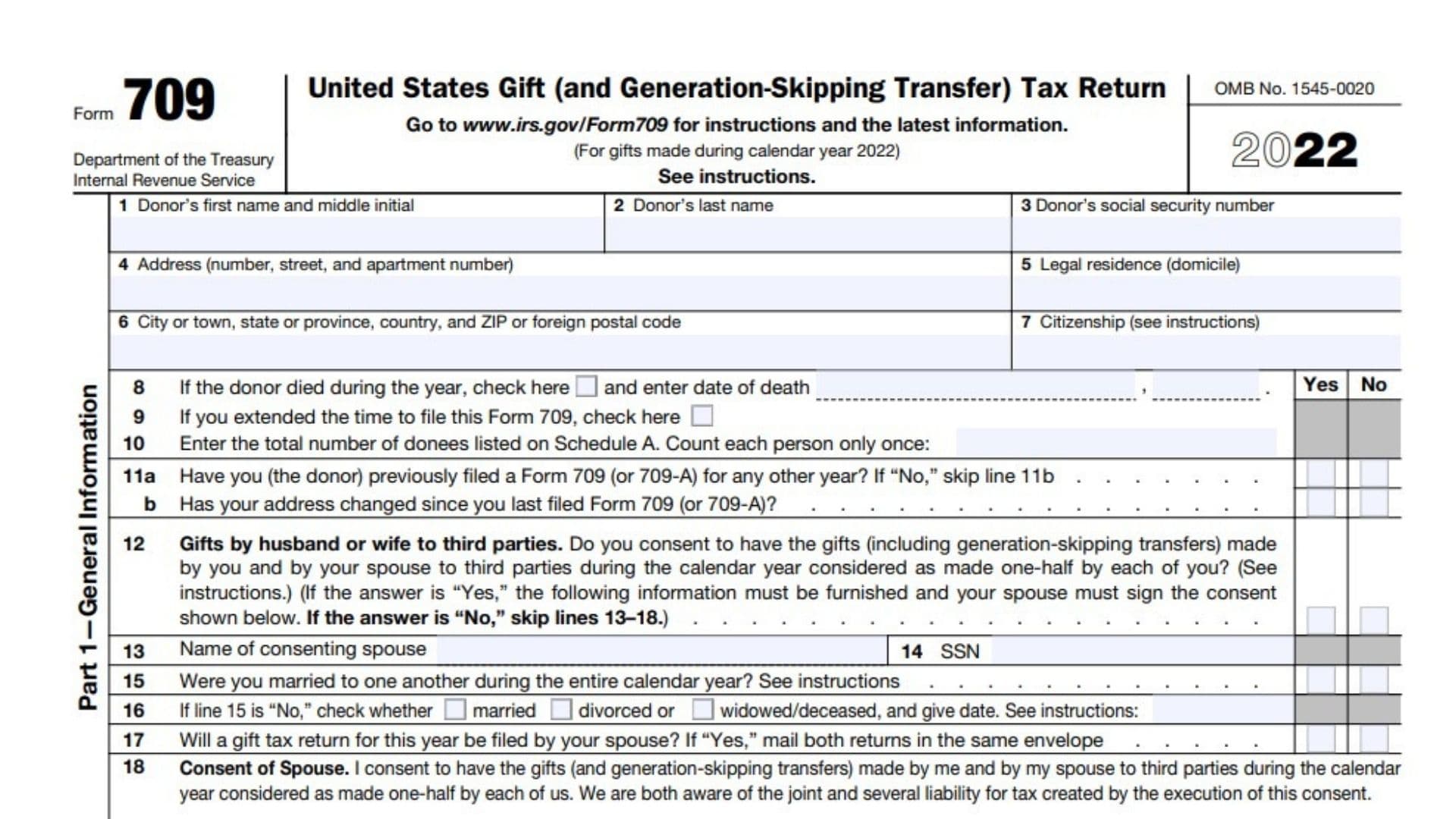

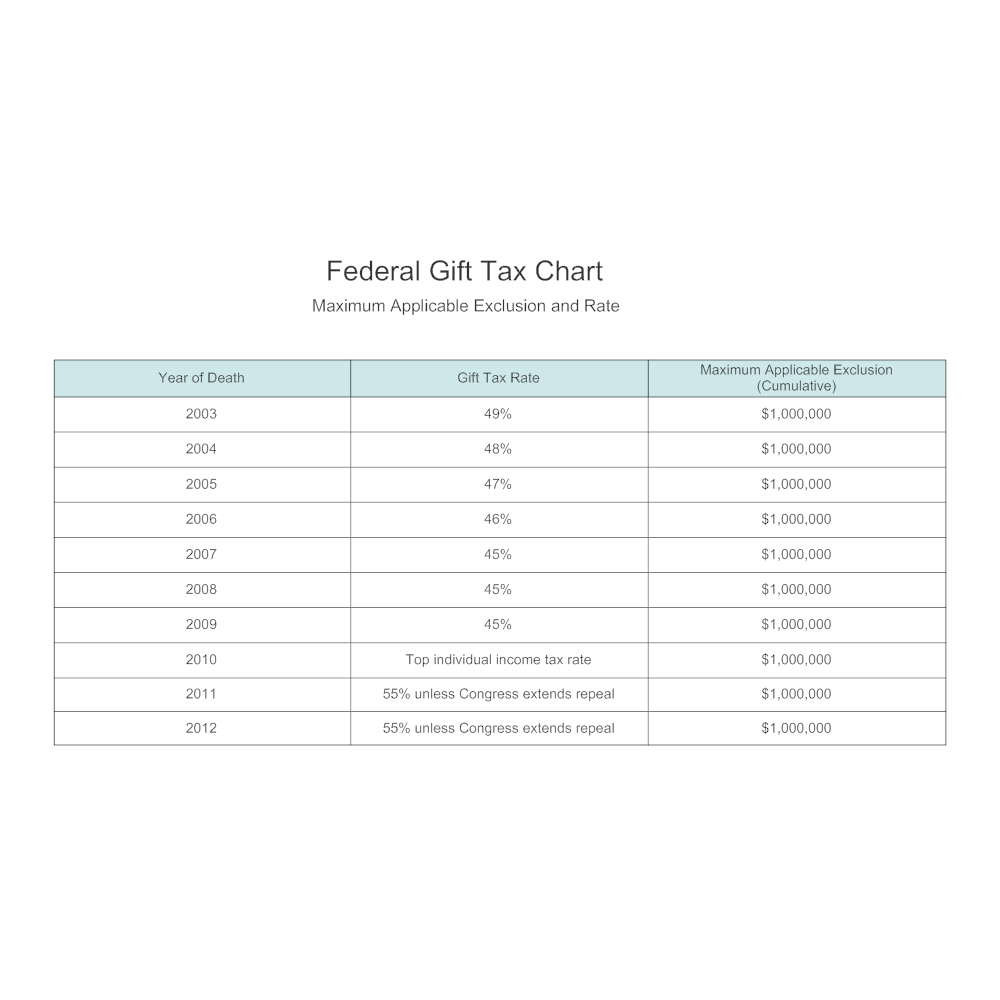

Regarding annual gifts, the current (2025) federal annual gift tax exclusion is $18,000.00 per u.s. The irs has announced a higher estate and gift tax exemption for 2025.

Gift Amount For 2025 Suzy Elfrieda, The irs has announced a higher estate and gift tax exemption for 2025.

Gifts For Hunters 2025. With so much gear to choose from, it can be hard to find the perfect gift. Searching for the best gifts for hunters? We found great gifts for hunters, whether the recipient is a shooter or bowhunter, duck hunter or deer hunter, fisherman and. Find some of the best gifts on […]

Annual Gifting For 2025 Image to u, The irs has announced a higher estate and gift tax exemption for 2025.

Lifetime Gift Tax Exclusion 2025 In India Dan Johnston, Federal annual and lifetime gift tax exclusion increase for 2025.

2025 Annual Gift Tax Exclusion Nelli Libbie, The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 from the 2025.

Annual Gift Exemption 2025. The irs has announced a higher estate and gift tax exemption for 2025. Here's what wealthy families need to know.

Current Estate Tax Exemption 2025 Ashli Camilla, The federal lifetime estate and gift tax exemption will sunset after 2025.

Annual Gift Exemption 2025 Audrey Mcdonald, Lifetime estate and gift tax exemption thresholds are poised to be cut in half at the stroke of midnight december 31, 2025, leading to a potentially sharp jump in some estates' tax.